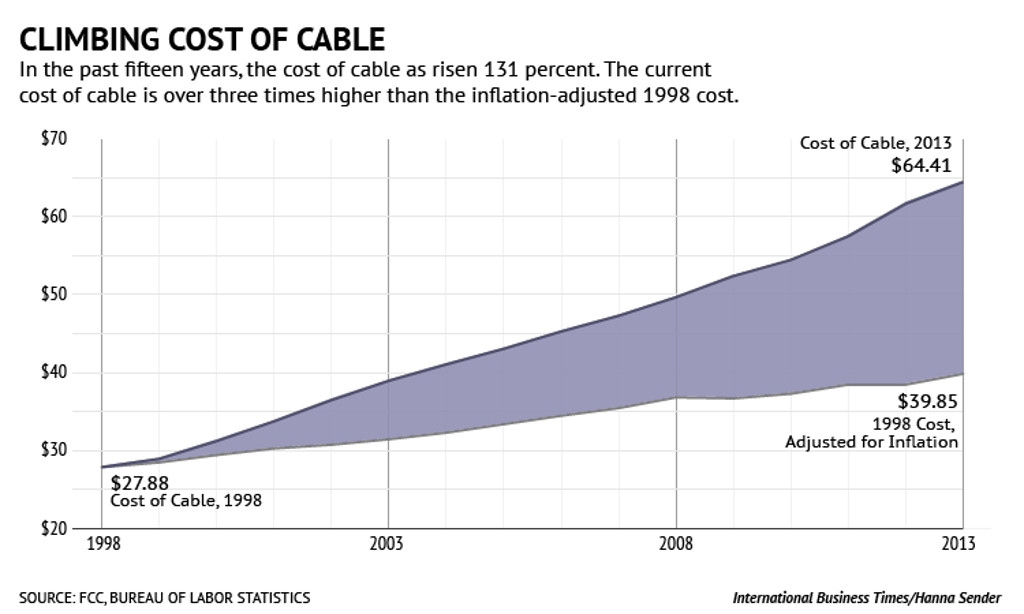

Another year, another increase to your monthly pay-TV bill.

Giants including Comcast Corp., Dish Network Corp. and AT&T Inc.’s DirecTV plan to raise rates again in the new year, a move that could boost revenue but risks alienating subscribers who have been ditching their traditional TV subscriptions in record numbers.

Recommended Video

Cable and satellite providers are hoping to squeeze more money from consumers who remain loyal to their packages with hundreds of channels, Philip Cusick, a JPMorgan Chase & Co. analyst, said in a note this week, even though “this strategy could accelerate video sub declines.”

It’s common for pay-TV providers to raise prices in the new year. They are passing on the rising costs they pay to carry networks like CBS and ABC, as well as regional sports channels like the YES Network, which are shelling out more and more for sports broadcast rights.

The latest price increases come as cord-cutting accelerates. In the third quarter, the TV industry saw its largest-ever rate of decline, with subscribers shrinking by 3.7 percent, according to Moffett Nathanson LLC. Consumers are dropping traditional TV for lower-cost online options like Netflix Inc. and slimmer TV options from Hulu and YouTube.

Why prices rise

Cable companies point to rising fees they pay to carry TV networks. The networks, in turn, have their own rising costs — particularly sports, as they willingly pay more to sports leagues for what they consider must-have programming. But the networks also know they can pass those costs back to cable companies and ultimately their subscribers.

It’s industry convention that a cable bundle needs live sports. Otherwise, cable companies risk losing subscribers to Netflix and other sports-less alternatives.

The consulting firm PwC estimates that sports leagues in North America raked in $18.4 billion in 2016 from TV, radio and tech companies that stream games, up from $11.6 billion in 2012. That’s expected to keep growing as tech companies such as Amazon and Facebook become more interested in sports, meaning more competition for rights to televise games.

The big winner in the TV ecosystem? “If anyone’s the beneficiary it’s NFL players,” Pivotal Research Group analyst Brian Wieser said.

Meanwhile, to get the biggest audience possible, many entertainment companies like Disney require cable companies to include expensive channels in the most popular bundles. Verizon tried to offer a cheaper package by dropping Disney’s ESPN from a basic package, making it an optional add-on. ESPN sued, and now Verizon offers a sports-focused basic package with ESPN alongside ones that don’t have sports.

Beyond sports, networks pay for high-quality TV series to compete with hits on Amazon, Netflix and other services. Those costs are passed along, too.

In all, S&P Global Market Intelligence estimates that network fees that cable companies are paying are nearly 2.5 times what they were a decade ago.